Luc Eyraud : “Several concomitant factors are at the origin of the financing shortage experienced by many sub-Saharan African countries”

During a press conference in Abidjan, Côte d'Ivoire, Luc Eyraud, Director of Regional Studies for Africa at the International Monetary Fund (IMF), presented the conclusions of the report on economic outlook for sub-Saharan Africa, highlighting both the progress made and the persistent challenges.

By the editorial team

During a conference held at the headquarters of the Ivorian Ministry of Finance, Luc Eyraud, Director of Regional Studies for Africa at the International Monetary Fund (IMF), presented the conclusions of the report on economic outlook for sub-Saharan Africa. Conclusions were nuanced to say the least.

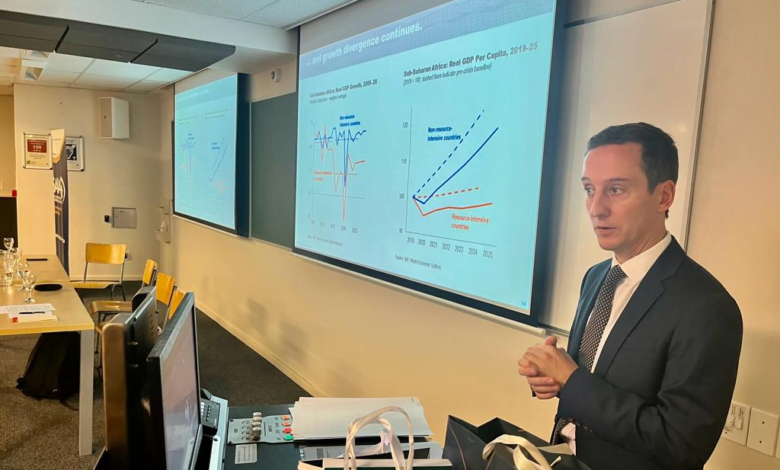

Indeed, after four years marked by economic turbulence, the region is experiencing a progressive improvement in its outlook. Economic growth is expected to rise from 3.4% in 2023 to 3.8% in 2024, with nearly two-thirds of countries anticipating higher growth. This positive trend should continue beyond 2024, with projected growth of 4.0% in 2025. Meanwhile, inflation has significantly decreased, and public debt ratios are stabilizing, with several countries even successfully issuing eurobonds, thus regaining access to international markets after a two-year absence.

The gross external financing needs for low-income countries are estimated at over $70 billion per year over the next four years

However, challenges remain. The region continues to face a financing shortage, with high borrowing costs and imminent debt repayment deadlines. Economic prospects remain vulnerable to external shocks, particularly increased risks related to political instability and climate disasters.

The reduction in traditional sources of financing, including official development assistance, partly contributes to this shortage, explained Luc Eyraud. « Several concomitant factors are at the origin of the financing shortage experienced by many sub-Saharan African countries, including the increase in global interest rates, the increase in spreads on sovereign bonds, and the depreciation of the region’s currencies against the dollar, » analyzed Luc Eyraud. The gross external financing needs for low-income countries in sub-Saharan Africa are estimated at over $70 billion per year over the next four years. As concessional sources become scarcer, governments are turning to alternative financing options, often associated with higher costs, less transparency, and shorter maturities.

The cost of borrowing, both domestic and external, has increased and remains high for many countries. In 2023, government interest payments represented 12% of its revenues (excluding grants) for the median sub-Saharan African country, more than double compared to ten years ago. The private sector is also beginning to feel the effects of higher interest rates.

The region remains vulnerable to global shocks

Risks to outlooks remain tilted to the downside. The region remains vulnerable to global shocks, particularly weaker external demand and elevated geopolitical risks. Additionally, sub-Saharan African countries face increasing political instability and increasingly frequent and intense climate shocks.

To address these challenges, the report identifies three strategic measures: restoring fiscal health without hindering development, pursuing a monetary policy focused on price stability, and implementing structural reforms to diversify the economy and sources of financing. Increased international cooperation is necessary to support these efforts aimed at building a more inclusive, sustainable, and prosperous future for sub-Saharan Africa.

Given the context, the IMF official discussed the situation of the countries in the new Alliance of the Sahel States (AES). « AES countries have decided to leave ECOWAS, but not the West African Economic and Monetary Union (WAEMU). Their departure from ECOWAS raises questions of uncertainty and investor perception, which may struggle to distinguish between the trade zone that is ECOWAS and the single currency zone that is WAEMU. There will be disruptions in trade and less significant disruptions in individual flows, » he announced.

Meanwhile, the host country of the meeting, Côte d’Ivoire, is doing well. « From 6.2% last year, Côte d’Ivoire’s real GDP is expected to reach 6.5% this year, driven by its agriculture and revenues from the three operating cycles of the Baleine gas and oil field, » said Luc Eyraud. Before nuancing his analysis again: « However, Côte d’Ivoire needs to improve its resilience by adopting tools and policies for climate resilience. Ivorian debt, representing 57% of its GDP at the end of 2023, is at moderate risk, and Côte d’Ivoire issued two Eurobonds in January of this year, worth $2.6 billion, to balance its liquidity and solvency ratios. Its debt ratio is expected to decrease to represent 53% of its GDP by 2027. »