Tech : is Africa the new Fintech eldorado?

Featured prominently at the latest Vivatech edition, Africa is undergoing a true Fintech revolution, propelled by its young, unbanked population and rapid adoption of mobile technologies. While Inclusivity Solutions, winner of the AfricaTechAwards, embodies this momentum, outside of success stories like M-Pesa or the unicorn Flutterwave, how many African fintechs are truly emerging while the sector faces major challenges, starting with a regulatory environment still cautious toward innovation?

By Dounia Ben Mohamed in Paris

Video report:

Unsurprisingly, Inclusivity Solutions, a South African startup aiming to « reimagine insurance through technology » by providing digital insurance solutions, clinched the Fintech award at the 2024 AfricaTechAwards. Founded in 2015, this startup recently raised $1.5 million to support its pan-African expansion projects, garnering keen interest at the latest Vivatech edition.

Billed as « Europe’s biggest tech rendezvous » by its promoters, Vivatech took place from May 22nd to 25th in Paris and once again served as a showcase for African innovation. Though fewer in number, African startups and the institutions supporting them were noticeable. AI was at the heart of this 2024 Vivatech edition, but on the African front, it’s fintech that’s booming and taking the spotlight. Fintech was, in fact, the category with the highest number of applications, 148 out of 310 at the AfricaTechAwards, indicating the sector’s burgeoning growth.

Nearly 700 million people are potential customers for Fintech services

Over the past decade, Africa has become fertile ground for Fintech innovations. With a population exceeding 1.3 billion, a vast majority of whom are young and unbanked, the continent offers immense growth potential for financial technology startups. Sub-Saharan Africa has approximately 66% of its population lacking access to formal financial services. This situation presents a unique opportunity for Fintech startups seeking to bridge this gap. According to a World Bank report, only 34% of adults in sub-Saharan Africa have a bank account, compared to 69% globally. This means nearly 700 million people are potential customers for Fintech services. Moreover, the burgeoning e-commerce sector could create around 3 million jobs in Africa by 2025.

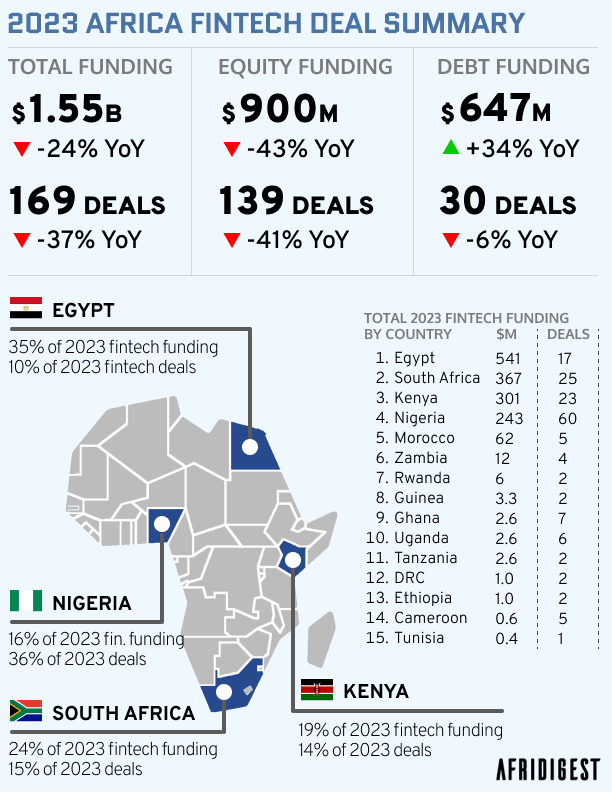

Thus far, Fintech growth in Africa has been impressive from 2020 to 2023. The number of Fintech companies in Africa increased significantly, with a growth of 17.7% from 2021 to 2023 according to the latest Disrupt Africa report. In 2021, the continent had approximately 576 Fintech companies, a figure that reached 678 in 2023. African Fintechs raised over $2.7 billion between 2021 and 2023, nearly double the funds raised between 2019 and 2021. Since 2015, 540 Fintechs from 25 countries have raised nearly $3.64 billion. Nigeria remains the leading market with 270 Fintechs in 2023, followed by South Africa with 140 companies and Kenya with 102 companies. These three countries account for 67.7% of African Fintech startups. Egypt witnessed a 66.7% increase in the number of Fintechs, and Nigeria recorded a 50% growth over the past two years.

As new markets emerge, including Burkina Faso, Lesotho, and Namibia, diversifying the geographical landscape of the African Fintech sector, activities are also diversifying. Payments and fund transfers remain the main activities of Fintechs, accounting for 29.4% of operations between 2021 and 2023, although this figure has decreased compared to previous years due to the emergence of new sectors such as lending, insurtech, and blockchain.

The M-Pesa success story

At the core of their success, African Fintechs are not merely replicating existing models; they are innovating by creating solutions tailored to the specific needs of local populations. A prime example is the success story of M-Pesa.

Mobile Money, or mobile cash, is arguably the most remarkable Fintech innovation in Africa. A pioneer of this movement, the M-Pesa service, launched by Safaricom in Kenya in 2007, has transformed how Africans manage their money. M-Pesa allows users to deposit, withdraw, transfer money, and pay for goods and services via their mobile phones. Today, M-Pesa has over 40 million users in several African countries, including Kenya, Tanzania, and Ghana. In 2020, the total value of Mobile Money transactions in sub-Saharan Africa reached $490 billion, according to the GSM Association, representing a 23% increase from the previous year.

The success of M-Pesa has inspired numerous similar initiatives across the continent. Among them, Flutterwave, a Nigerian startup founded in 2016, has become a leader in the online payment sector. The company enables businesses to receive payments from their customers across Africa and beyond. In 2021, Flutterwave raised $170 million in a Series C funding round, valuing it at over $1 billion, making it one of the few African unicorns. Another notable startup, Chipper Cash, offers money transfer and cross-border payment services. Founded in 2018, it has rapidly gained ground due to its very low transaction fees and user-friendly interface. Chipper Cash operates in several countries, including Ghana, Kenya, Nigeria, Uganda, and Rwanda, and raised $100 million in 2021.

African states are not sufficiently open to these technological innovations

However, despite this strong growth, about 20% of the Fintechs listed between 2019 and 2021 ceased operations over the past two years, underscoring the challenges they face. Lack of technological infrastructure, strict financial regulations, and consumer mistrust of digital financial services are all obstacles to overcome. « Regulation is the big issue, » observes one consultant. « African states are not sufficiently open to these technological innovations for various reasons. In Tunisia, for example, the Central Bank has delegated licensing to traditional banking players, who are resistant to these Fintechs because they see them as competitors. » Challenges faced by Binance in Nigeria, new taxation in Kenya, and, generally, a regulatory framework not yet adapted to the sector, or even limiting its growth, are hindering activity.

Cybercrime is another major problem. Fintechs must invest heavily in security to protect user data and build trust in their services. According to a Serianu report, a cybersecurity company based in Kenya, the annual cost of cybercrime is around $3.5 billion.

Fintech could enable the continent to play a leading role in the impending global financial revolution

Investor interest in African Fintechs is further solidifying. In 2020, African Fintech startups attracted $1.35 billion in investments, marking a 55% increase from the previous year. In total, $2.7 billion was raised by African startups between July 2021 and June 2023. Despite a downturn in investment across sectors in 2023, Fintech remains investors’ favorite. This trend is expected to continue upward, disrupting the traditional finance world towards more innovation and inclusivity. This could potentially position the continent to play a leading role in the impending global financial revolution.

Meanwhile, also nominated for Fintech of the Year at the upcoming Bankers Awards, Inclusivity Solutions celebrates its victory, which « testifies to the hard work and dedication of our team in promoting financial inclusion in Africa, » shared the startup on social media. Other startups that may not have received awards nonetheless achieved their goals by meeting potential partners and investors, the main mission of Vivatech being to promote global technological innovation. This year, over 13,500 startups also had the opportunity to establish business relationships with companies across more than 25 sectors and meet over 2,000 investors and investment funds.