In Africa, and always, women and entrepreneurship go hand in hand !

Women entrepreneurs represent a vital component of the flourishing economy of the African continent. This is an undeniable fact. Indeed, Africa has the highest rate of women entrepreneurs in the world, with approximately 26% of adult women involved in entrepreneurial activities.

By Dhekra Khelifi, founding partner 216 CAPITAL.

The Women in Africa Entrepreneurship Study (2018) by Roland Berger revealed that women entrepreneurs contributed between $250 and $300 billion to Africa’s economic growth in 2016, which is equivalent to about 13% of the continent’s GDP. Additionally, according to McKinsey, the female economy is the largest emerging market in the world, with the potential to add $12 trillion to the global GDP by 2025.

These women inject renewed dynamism, constant innovation, as well as unmatched creativity and resilience into their businesses. However, despite their rich tradition of entrepreneurship and their prominent presence in various economic sectors, they unfortunately remain underrepresented, especially in the fields of technology and digital.

Fewer women in technology and digital

This underrepresentation of women entrepreneurs in the technology and digital sectors can be explained by a set of factors. Among these, structural barriers in several countries on the continent such as limited access to education and financial resources can be cited. Additionally, gender stereotypes and socio-cultural expectations, as well as unconscious and systemic biases from investors, also contribute to this situation.

Investor biases:

Investors, whether consciously or not, can fall victim to biases that directly impact their investment decisions. Missing out on an investment opportunity due to these often unconscious practices is a significant loss for the investor because their role is to unearth startups that will ensure economic gains throughout the value chain. Passing up on 50% of the sample size by excluding startups led by women due to prejudices is certainly the biggest missed opportunity in this industry!

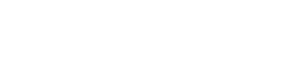

These biases, often overlooked, and the often underestimated economic gain mean that the number of startups led by women accessing investment is very low, bordering on embarrassment.

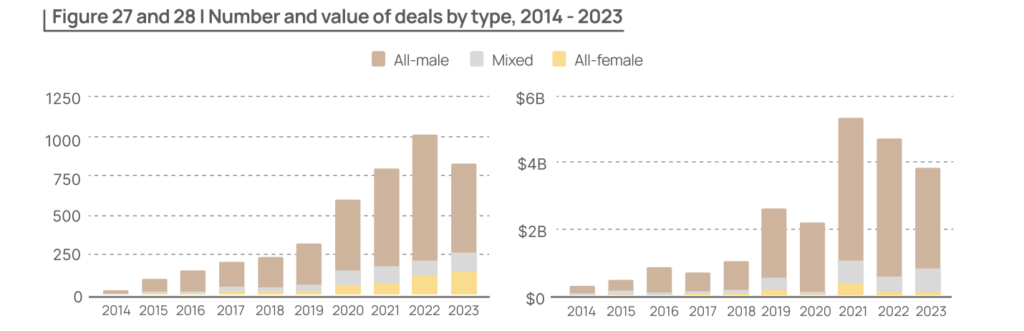

African women tech entrepreneurs who successfully raised funds in 2023 did so in almost all sectors, even those not traditionally associated with women due to these cultural biases. Given equal opportunities, women were able to have their say.

Furthermore, the number of women in VCs in Africa is increasing in an encouraging manner. Representation matters and can change mindsets. It is essential that the perspectives of women investors are also taken into account in the selection phases and in the various stages of fundraising, and even beyond in support and development.

Startups led by women succeed and outperform!

Unless there is a total and irrevocable paradigm shift, we will continue to see investors predominantly favoring companies owned by men. Women will unfortunately continue to encounter more gender-based obstacles when seeking funding from investors and banks.

However…

Since women are less likely to be backed by a VC, their startups will face more meticulous evaluation. These biases from investors will mean that they will not be impressed unless they are exposed to something that surpasses their expectations to obtain funding. These companies are therefore often predisposed to « outperform » thereafter.

Another important factor is that since founders are often more clear-headed in terms of financial forecasts, they tend to only raise what they need. They focus more on « unit economics » and efficiency, making them more effective managers.

How to approach investment for startups led by women?

- Network/Recommendation: Create and maintain strong connections with other entrepreneurs, industry professionals, and potential investors. When you think a VC could be the right match and you know a founder from their portfolio, ask them to introduce you. Founder introductions are taken into account and taken very seriously by investors.

- Speak Up/Be Confident: You master your subject: Convincingly highlight what makes your business investable. Highlight your innovative technology, your business approach, or your industry experience. The idea is not to copy the style of a male entrepreneur but to use your own strengths without succumbing to comparisons or sometimes biased standards of how to present your business. Be yourself and above all, be the first person to believe in yourself. It’s contagious.

- Team/Collaboration/Leadership: Build a strong and united founding team. Investors attach great importance to the team, so prove that your team has the ability to realize your vision and demonstrate your contribution.

- Be Persistent: The quest for funding can be challenging, but maintain your perseverance and resilience in the face of rejection and obstacles.

- Understand Investors: Grasp the investment criteria of VCs and be open-minded to adjust your approach accordingly. Target the investors who best match your company and vision and especially prioritize those who have already invested in women!

- There are alternatives! VCs and banks are not the only means to finance a business. Crowdfunding is one that seems to escape biases and offers funds from individuals (or entities) who want to invest and invest solely on the basis of merit. Moreover, these platforms offer exposure to different actors and could be a boon to meet potential customers and develop brand image. In the critical early stages of launching a startup where 60% of startups fail to survive (more so for startups led by women), Crowdfunding can become the alternative that will save the gems led by women in Africa!

For women tech entrepreneurs in Africa, it is clear that the path is more difficult for reasons that are often unfair and harmful. But the women of this continent will never accept being « victims ». It is not in African women’s genes to wait for things to change because they know that they have always carried this continent on their shoulders, their backs, and now on the tips of their fingers. I remain confident that the years to come will be marked by the long-awaited exploits of startups led by women in Africa.