Egypt‑Qatar : strategic LNG agreement to secure energy supply

On 4 January 2026, Egypt and Qatar signed in Doha a memorandum of understanding (MoU) aimed at strengthening their cooperation in the energy sector, particularly in liquefied natural gas (LNG) imports. As Egypt faces declining domestic production and rising energy demand, this partnership addresses both immediate supply needs and a broader regional vision for energy cooperation.

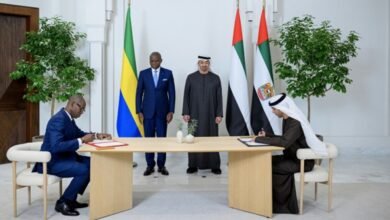

On 4 January 2026, Egypt and Qatar officially signed in Doha a memorandum of understanding (MoU) to enhance energy cooperation between the two countries, particularly regarding the sale and import of liquefied natural gas (LNG). The agreement was signed by Karim Badawi, Egypt’s Minister of Petroleum and Mineral Resources, and Saad Sherida Al‑Kaabi, Qatar’s Minister of State for Energy Affairs, President and CEO of QatarEnergy, during an official ceremony at QatarEnergy headquarters.

Meeting energy demand beyond domestic production capacity

According to the joint statement, the MoU paves the way for expanded cooperation in the energy sector, specifically ensuring deliveries of Qatari LNG to Egypt’s Ain Sokhna and Damietta ports, with an operational agreement for the supply of up to 24 LNG cargoes during the upcoming summer of 2026. This framework aligns with Egypt’s strategy to meet energy demand that now exceeds domestic production capacity.

In his remarks, Saad Sherida Al‑Kaabi highlighted Qatar’s intent to “further enhance our cooperation with Egypt,” noting that this agreement “builds on our recent successful cooperation with Egypt particularly with respect to the supply of LNG from QatarEnergy’s portfolio.” He added that the partnership not only aims to meet current energy needs but also facilitates discussions on longer-term LNG supplies, which could help stabilize Egyptian energy provision beyond the summer season.

This signing comes as Egypt, a former gas exporter, has become a net importer again

This signing comes as Egypt, a former gas exporter, has become a net importer again, following a decline in domestic production. Available data show the country produced approximately 3,635 million cubic meters of gas in October 2025, slightly higher than the previous month but below the 3,851 million cubic meters recorded in October 2024, reflecting a downward trend in internal supply.

This production slowdown is partly linked to the gradual depletion of certain fields, notably Zohr, the largest gas field in the Mediterranean, which had fueled Egypt’s ambitions to become a regional energy hub. Facing these constraints, Cairo has multiplied LNG import agreements while continuing to explore new blocks and attract investment in upstream development.

For Egypt, the signing of this MoU with Qatar represents a key step in securing its energy supply, particularly ahead of winter and summer consumption peaks, when domestic electricity and gas demand intensifies. It complements other recent initiatives, such as agreements with Israel and Cyprus (sometimes delayed), and maritime import projects to meet short-term needs.

Strengthening its position as a regional energy hub

Energy cooperation between Cairo and Doha is not limited to spot cargoes. The MoU opens the door to discussions on longer-term LNG supply contracts, which could provide Egypt with more stable energy planning, reduce dependence on often expensive spot markets, and reinforce its role as a regional energy hub.

From a geopolitical and economic perspective, this partnership also allows Qatar—the world’s leading LNG exporter—to diversify its markets beyond Europe and Asia, consolidating its presence in a strategic and growing African market. Qatar’s agreements with Egypt are part of a broader set of diplomatic and economic efforts to develop sustainable energy relations with multiple countries in the region and across the continent.

The impact of this partnership goes beyond LNG imports: it strengthens bilateral ties between Cairo and Doha, while giving Egypt greater flexibility to stabilize its energy balance, better plan supply, and attract additional investment in its gas sector.

Pillars of a broader pan-African energy strategy

As Africa continues its demographic and economic growth, agreements with gas suppliers like Qatar could become pillars of a wider pan-African energy strategy—diversifying sources, reducing vulnerabilities tied to local production, and supporting more integrated energy transition ambitions.

Thus, the evolution of the Egypt-Qatar energy partnership reflects a broader trend: the growing role of Gulf producing states in the African energy landscape, where targeted agreements can contribute to energy security, attract investment, and promote regional cooperation over the long term.