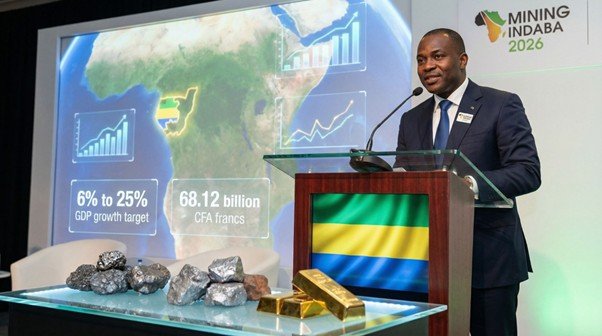

Mining Indaba 2026 : a new mining era emerges

From February 9 to 12, 2026, the major event of Africa’s mining industry, Mining Indaba, was held in Cape Town, South Africa, bringing together public decision-makers, investors, and key actors of the sector. This took place in a context where several African countries are reforming their regulatory frameworks to better capture the value of their resources…

By Bylkiss Mentari, in Cape Town

As every year, the largest mining conference on the African continent was held from February 9 to 12 in Cape Town. According to the organizers, the objective for 2026 is to build strong partnerships between governments, investors, mining companies, and communities, in order to structure the value chain of critical minerals essential to the global energy transition. Africa holds approximately 55% of the world’s cobalt reserves, as well as significant shares of manganese and platinum group metals, giving the continent a central role in global supply chains.

For African countries, this translates into a major economic and political movement: reviewing their legislative and regulatory frameworks to increase their share of local added value while preserving the sector’s attractiveness. Guinea illustrates this shift well.

Guinea: Focusing on Sovereignty and Attractiveness

Guinea, rich in bauxite, iron, and other minerals, has undertaken a reform of its mining rules in recent years to strengthen its role in the exploitation and processing of its resources.

For instance, the recent inauguration of Simandou, one of the largest and richest untapped iron ore deposits in the world, with over 65% iron content, is a $20 billion-plus project involving Rio Tinto and Chinese consortiums. It targets a production of 120 million tons per year, with the first export expected by late 2025-2026. This positions Guinea as a strategic global hub for the mining industry, with an ambitious vision of transformation and industrial integration.

Building sustainable value chains requires clear policies, appropriate infrastructure, and long-term partnerships

Beyond Guinea, other African countries are revising their mining codes or royalty regimes to better capture economic returns. For example, Ghana recently announced an increase in mining royalties, a step toward a fairer redistribution of sector benefits.

« Building sustainable value chains requires clear policies, appropriate infrastructure, and long-term partnerships, » a World Bank participant summarized.

These reforms are part of a broader logic of economic sovereignty, aimed at reducing dependence on raw material exports, encouraging local processing, technology transfer, and job creation. They also respond to growing pressure from populations for their natural resources to generate a sustainable impact on national development.

One of the key messages of Mining Indaba 2026 is that Africa cannot succeed alone, but that the balance between strengthened national rules and legal certainty for investors is crucial. Sessions notably addressed how African countries can reconcile resource nationalism with investment certainty, a key debate to attract capital while retaining strategic control over the mining sectors.

Partnerships and Attractiveness: A Balance to Find

The conference also highlighted structural issues, such as the need to invest in infrastructure, local training, industrial processing, and transparent governance. Social and environmental sustainability, as well as integrating local communities into project benefits, remain essential to strengthen the legitimacy of mining industries.

At a time when global demand for critical minerals—essential to green technologies and electrification—is growing sharply, Africa has exceptional potential. But capturing value within the continent while remaining attractive to international partners remains one of the main challenges.