International : the global economy at a crossroads

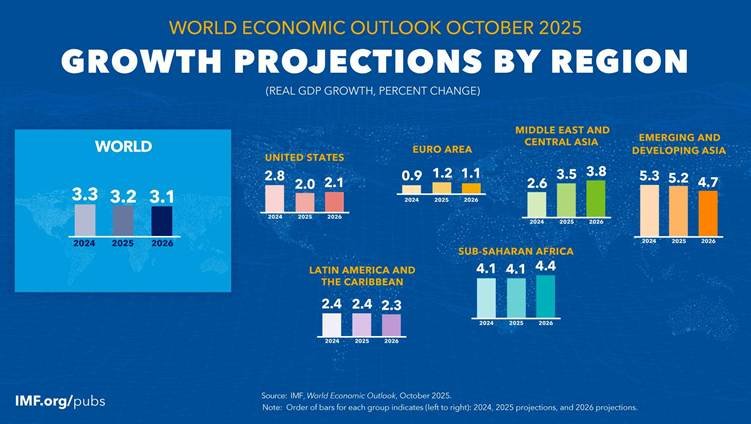

According to the latest World Economic Outlook recently published by the International Monetary Fund (IMF), global growth is expected to reach 3.2% in 2025, down from 3.3% in 2024, before slowing to 3.1% in 2026. Despite this slight upward revision compared with the April forecast, prospects remain fragile amid geopolitical uncertainties and trade tensions.

The global economy continues its slow adaptation to a reconfigured economic environment. After successive shocks related to the pandemic, geopolitical tensions, and trade adjustments, the IMF’s outlook shows moderate but stable growth.

A global economy resilient to headwinds

“We project global growth of 3.2% for 2025. This remains below pre-pandemic levels but reflects a global economy resilient to headwinds,” said Pierre-Olivier Gourinchas, IMF Chief Economist, during the report presentation in Washington.

“Emerging and developing economies are expected to grow just above 4%, supported by the recovery in Asia, investment in Africa, and the resilience of certain Latin American markets.”

This relative stability, however, masks deep disparities. Advanced economies are expected to grow around 1.5%, constrained by still-restrictive monetary policy and low productivity. In contrast, emerging and developing countries should grow just above 4%, supported by Asia’s recovery, investment in Africa, and the resilience of some Latin American markets.

Beneath the steady surface, complex forces are at work

“Beneath the steady surface, complex forces are at work,” the IMF report notes, highlighting rising protectionism, labor market tensions, and public debt risks.

Inflation easing, but policies require fine-tuning

Global inflation continues to ease thanks to lower energy prices and central banks’ monetary tightening. However, the IMF notes persistent regional differences: inflation remains above target in the United States, moderate in Europe, and generally under control in emerging markets.

The Fund recommends that governments rebuild fiscal space while maintaining credible monetary policy.

“Policymakers must address fiscal vulnerabilities and enhance public debt transparency to avoid a return of volatility,” the report warns.

Structural reforms still essential

Given the slow pace of recovery, the IMF emphasizes the need for structural reforms to boost productivity and enhance economic resilience. This includes supporting innovation, diversifying trade, and improving economic governance.

“It is time to implement credible, transparent, and viable policies to support inclusive and sustainable growth,” the report concludes.

Chapter 3 of the report also cautions against poorly calibrated industrial policies: while they can enhance competitiveness, they must consider “opportunity costs and trade-offs.”

The challenge: balancing fiscal discipline, financial stability, and productive investment

Overall, despite a slight upward revision of projections, the IMF remains cautious: the global economy remains vulnerable to new external shocks. The challenge now is to strike a balance between fiscal discipline, financial stability, and support for productive investment.