FDI : Record high in 2024, but where is the money going ?

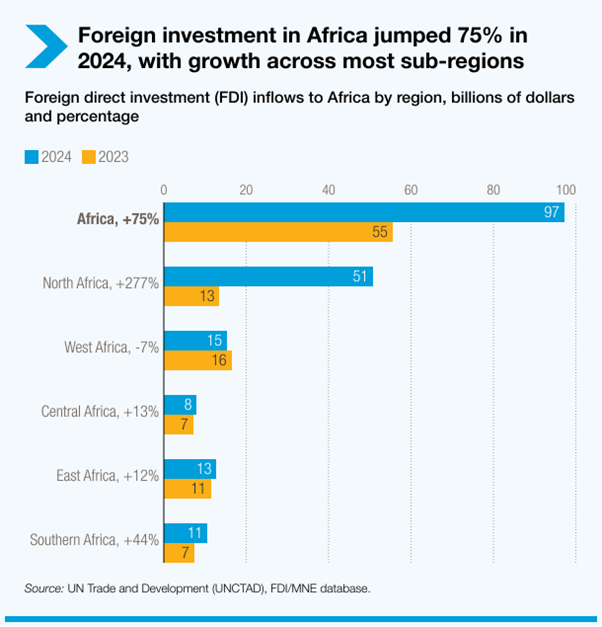

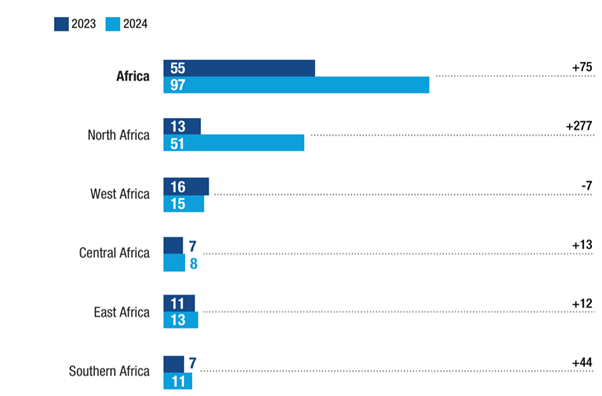

According to The United Nations Conference on Trade and Development (UNCTAD), Foreign direct investment (FDI) in Africa surged by 75% to a record $97 billion in 2024, driven by liberalization efforts and facilitation policies across the continent, according to the latest UNCTAD report. Yet challenges remain in directing these funds toward key sectors for sustainable development.

The United Nations Conference on Trade and Development (UNCTAD) World Investment Report 2024 reveals a remarkable 75% increase in FDI inflows into Africa, reaching $97 billion. This surge is largely attributed to a large-scale international financing agreement for urban development projects in Egypt, serving as a catalyst for the continent’s investment growth.

Excluding this exceptional factor, Africa’s FDI still grew by 12% to approximately $62 billion, representing around 4% of global FDI flows. This contrasts with the global trend, where FDI declined by 11% for the second consecutive year, highlighting a marked slowdown in productive capital flows amid global economic uncertainties.

Africa attracts investments amid global downturn

FDI fell sharply in developed economies, particularly in Europe, reflecting economic uncertainties and geopolitical risks. Although inflows to developing countries appeared stable, this masks a deeper crisis: capital is often stagnant or misallocated away from critical sectors such as infrastructure, energy, technology, and industry — key engines for job creation.

UNCTAD Secretary-General Rebeca Grynspan noted: « Too many economies are being left behind, not because they lack potential, but because the system continues to channel capital where it is easiest, not where it is needed most. »

This highlights the need for Africa to enhance investment facilitation policies. In 2024, investment facilitation measures accounted for 36% of Africa’s policy initiatives, with liberalization efforts making up about 20%, reflecting a commitment to improving the business environment.

European investors hold the largest stock of FDI in Africa, followed by the US and China

European investors hold the largest stock of FDI in Africa, followed by the US and China. Chinese investments, estimated at $42 billion, are diversifying into pharmaceuticals and agribusiness. A third of Belt and Road Initiative projects focus on social infrastructure and renewable energy, confirming the rising importance of these sectors.

North Africa led the regional growth, with Tunisia’s FDI rising 21% to $936 million and Morocco’s surging 55% to $1.6 billion. Egypt remains the regional powerhouse with more than doubling international project finance commitments.

Renewable energy is the only sector with notable growth — seven major contracts worth approximately $17 billion mainly for offshore electrical cables and solar and wind farms in Egypt, also extending to Tunisia, Morocco, and Namibia.

Paradox of growth vs. new projects decline

Despite overall growth, new project announcements in Africa fell 5%, with their value plunging 37% from $178 billion in 2023 to $113 billion in 2024. Most countries saw declines except North Africa, where new projects grew 12%, representing two-thirds of the continent’s investment spending.

Construction and metal products sectors saw the strongest increases in new projects, while electricity and gas supply projects dropped by $51 billion.

Cross-border mergers and acquisitions, typically about 15% of African FDI, turned negative, reflecting increased investor caution.

“Capital must be directed toward high-impact sectors — infrastructure, energy, technology, and industry — to foster inclusive growth”

The surge in FDI presents a key opportunity for Africa’s economic transformation, but capital must be directed toward high-impact sectors — infrastructure, energy, technology, and industry — to foster inclusive growth.

The continent must continue economic liberalization, administrative simplification, and business climate improvements, balancing environmental and social sustainability.

Regional integration, partner diversification, and capacity building remain critical to maximizing the benefits of these investments.