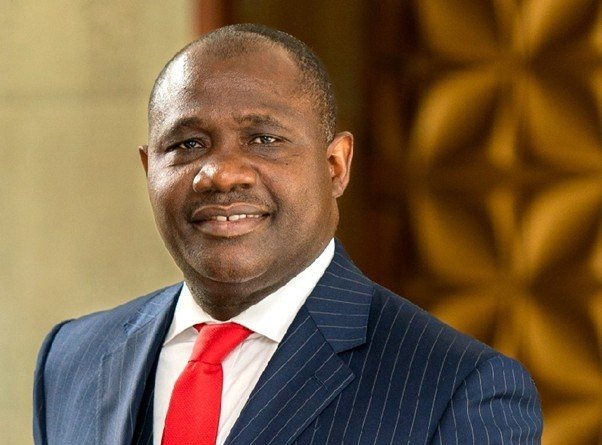

Emmanuel Lamptey : at the heart of Africa’s digital banking transformation

Appointed Executive Director in charge of Digital Banking at United Bank for Africa (UBA), Emmanuel Lamptey embodies the new generation of African banking leaders. His cross‑sector expertise and digital leadership are seen as strategic levers to strengthen innovation, customer experience and financial inclusion across the continent.

United Bank for Africa (UBA) is navigating a key phase of its development. Present in 20 African countries and on four continents — in the United Kingdom, the United States, France and the United Arab Emirates — the bank employs more than 30,000 people and serves over 50 million customers worldwide. In this dynamic context, the appointment of Emmanuel Lamptey as Executive Director in charge of Digital Banking, effective January 1, 2026, symbolises the strategic importance placed on digital transformation.

With 25 years of multinational experience across diverse functions — retail banking, corporate banking, asset management, securities brokerage, insurance and microfinance — Mr Lamptey brings a rare profile at the intersection of traditional financial expertise and contemporary digital challenges. He has led operations in more than 30 African countries, positioning his leadership at the interface between local markets and international standards.

A “strategist of operational excellence”

Emmanuel Lamptey has a solid and international educational background: a graduate of Harvard Business School, he is also a Fellow of the Association of Chartered Certified Accountants (UK) and holds a bachelor’s degree in commerce from the University of Cape Coast (Ghana). This combination of academic excellence and practical experience gives him a strategic vision particularly suited to the challenges of digital banking.

The transformations currently affecting the African financial sector — driven by demographic growth, rapid urbanisation and the explosion of mobile access — require leadership capable of thinking about innovation beyond traditional boundaries. In a World Bank report, it is noted that sub‑Saharan Africa could have more than 500 million bank accounts connected to digital services by 2025, a clear sign of the rise of digital banking on the continent. It is precisely at the heart of this dynamic that Mr Lamptey positions himself.

Drawing on his background, he is described by some financial observers as “an architect of operational excellence,” capable of accelerating the shift from traditional financial services to integrated digital platforms that meet the needs of modern African consumers. His experience in governance — both at executive level and as a member of boards of directors — gives him a strategic perspective on the synergies possible between digitalisation, customer experience and sustainable value creation.

The appointment of Emmanuel Lamptey fits into UBA’s succession strategy, which also sees the retirement of several long‑standing group executives, such as Ms Abiola Bawuah, Mr Alex Alozie and Ms Sola Yomi‑Ajayi, making way for a new generation of leaders. Tony Elumelu, Chairman of the UBA Group, emphasised the importance of this renewal, stating:

The Board is confident that they will bring the experience, depth and execution capability needed to build on the solid foundations laid by their predecessors and to propel UBA into its next phase of growth

This statement reflects the significance UBA places on leadership transition that combines heritage and innovation.

At the forefront of Africa’s digital finance

The challenge of digitalisation for UBA goes beyond online services: it touches on the financial inclusion of the unbanked, improving access to financial services in rural areas, and adapting to the new expectations of young African consumers. According to Financial Inclusion Insights (FII), nearly 67% of African adults have a financial account, but active use of sophisticated services remains below the global average. The implementation of innovative digital offerings is therefore essential to bridge these structural gaps.

As international competition intensifies — with global players, emerging fintechs and widely used mobile payment solutions — the appointment of an expert like Emmanuel Lamptey sends a strong signal: UBA aims to be at the forefront of Africa’s digital finance. This strategy is not merely technological; it is also cultural — reflecting a deep understanding of African ecosystems, their challenges and the opportunities they present.

Through his background, expertise and vision, Emmanuel Lamptey embodies a new generation of African leaders capable of steering finance toward ambitious digital horizons. As UBA prepares to enter a new chapter of its history, his role at the head of Digital Banking will undoubtedly be one of the main catalysts for innovation, financial inclusion and sustainable growth for the group across the continent.