DJamo & Agribora : african fintechs reinventing the Financial landscape

DJamo and Agribora exemplify the rise of Fintechs in Africa, each in its own area of expertise. While DJamo focuses on general financial services, Agribora specifically addresses the needs of the agricultural sector. Together, these startups showcase flourishing innovation and the positive impact of Fintechs on the African continent.

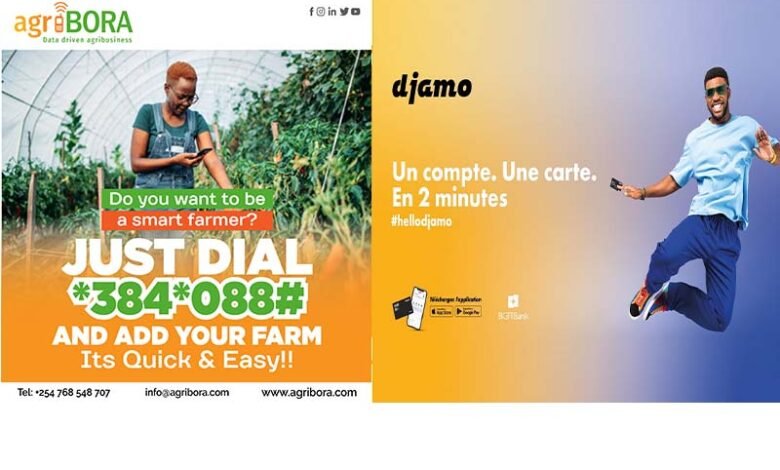

DJamo: The Made in Africa Fintech Revolutionizing Financial Services

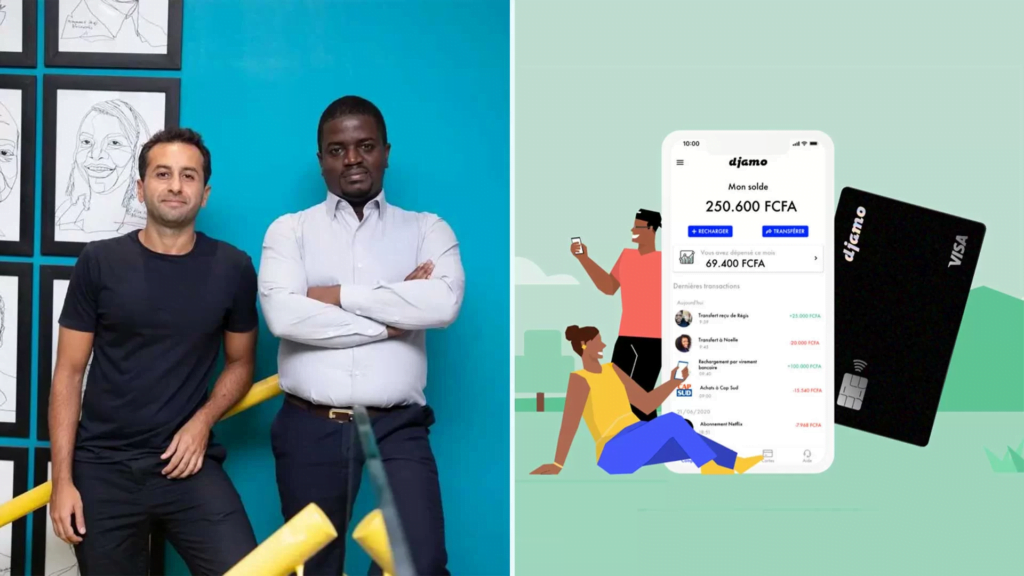

Founded in 2020 by Régis Bamba and Hassan Bourgi in Côte d’Ivoire, DJamo stands out in the burgeoning landscape of financial technology in Africa by offering innovative and accessible solutions to meet the needs of often underbanked populations. This African startup aims to revolutionize financial services on the continent by providing products and services designed to facilitate financial transactions, savings, and access to credit for individuals and small businesses.

With its user-centered approach and commitment to financial inclusion, DJamo has established a strong presence in the African Fintech market. By leveraging technological advancements such as mobile payments, crowdfunding platforms, and digital banking services, DJamo is contributing to transforming how financial services are perceived and accessed across the continent.

The startup raised a $14 million funding round in 2022—the largest funding round ever for a startup in Côte d’Ivoire—to expand throughout French-speaking Africa.

Agribora: The Kenyan Agrifintech Revolutionizing Agriculture

A trailblazer in many ways, Agribora, a Kenyan startup founded in 2018 by Kizito Odhiambo, embodies the convergence of agriculture and financial technology by offering innovative solutions to support farmers in Kenya. As an agrifintech, this startup combines technological advancements with the specific needs of the agricultural sector to facilitate access to financing, improve farm management, and boost agricultural productivity.

By leveraging technologies such as blockchain, artificial intelligence, and data analytics, Agribora is opening up new opportunities for the Kenyan agricultural sector. The startup aims to address some of the key challenges facing farmers in Kenya, such as limited access to financing and volatility in agricultural commodity prices, while strengthening the resilience and prosperity of agricultural communities in the country.

Tech for Development

DJamo and Agribora are inspiring examples of African innovation in the Fintech field. Their unique approaches and solutions tailored to African realities demonstrate the immense potential of African startups to transform the financial and agricultural landscape of the continent. These Fintechs play a significant role in empowering individuals, communities, and key sectors of Africa’s economy, contributing to the continent’s growth and sustainable development.