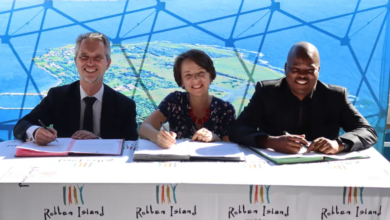

Akinwumi Adesina « Africa is on the cusp of unmatched economic transformation »

On the sidelines of the UK-Africa Summit, the president of the African Development Bank, Akinwumi Adesina, called on British investors to take part in the dynamism of the African continental free trade area.*

As you would have noticed, the presence of all of us from Africa, with Presidents and Heads of State from 12 countries, certainly brought a lot of much-needed sunshine to London. And that’s a free export from Africa: it is duty-free and quota-free !

» The Africa of the 21st century is a new and more confident Africa «

The Africa of the 21st century is a very different Africa. The Africa of the 21st century is a new and more confident Africa. Just think of the numbers. The population of Africa, at 1.3 billion people, will rise to reach 2.6 billion by 2050. With the youngest population in the world, Africa will drive the global labor market, as its young people impact the world with creativity, innovation and entrepreneurship.

Africa’s business-to-business and consumer-to-consumer expenditure could reach $5.6 trillion by 2020. The size of the food and agriculture market will reach $1 trillion by 2030.

Africa’s economies are showing a strong performance. Last year, 17 countries had real GDP growth of 3-5% and 20 countries grew at 5% and above. At least five of the fastest-growing economies in the world are in Africa.

Foreign direct investment in Africa last year increased by 11% compared to 4% in Asia. However, foreign direct investment declined by 13% globally and 23% in developed economies.

And you can feel the impact of Africa’s growth right here in London. Today, 110 African companies are listed on the London Stock Exchange, with market capitalization of $197 billion.

As wealth grows in Africa, it leads to wealth growth for the UK.

Africa and the UK have strong historical trading and cultural ties. It is these ties that give investors from the UK a head start with Africa. Africa is home to 19 out of the 53 member states of the Commonwealth. Today, many of them are huge markets, brimming with enormous investment opportunities.

In 2018, the Commonwealth had a combined annual GDP of $11.9 trillion. With a population of 2.5 billion people, the Commonwealth accounts for one-third of the world’s population.

Africa and the UK should be major trading partners. The reality, however, is that the UK’s trade with Africa is trending downwards. From a $49 billion peak in 2012, trade decreased to $30.6 billion in 2018.

The UK’s trade with Africa is also highly concentrated. The top-5 African trading partners account for 72% of trade with the UK, with South Africa and Nigeria alone accounting for almost half of the total trade.

The trade mix does not favor Africa. While the UK’s exports to Africa are focused on machines, mineral fuels and oils, electrical equipment and pharmaceutical products, Africa’s exports are mainly primary commodities: minerals, oil and gas, precious metals, edible fruits and nuts.

I know we talk a lot about the importance of Africa to the UK. But the reality is that Africa accounts for a miniscule share of the UK’s total trade. That share was 4% in 2012. Today it has declined to 2.6%.

Foreign direct investment from the UK to Africa has declined by a third since 2015 – standing now at $45 billion.

» The trends need to change! «

These trends are all in the wrong direction. The trends need to change!

The fact that we are having this conversation in the UK Parliament is a great start. The convening of this Summit by Prime Minister Boris Johnson is an even greater start.

I would like to suggest some ways in which we can recalibrate the UK-Africa trade and investment relationship.

First, the UK should ramp up investments in Africa. The opportunities speak for themselves. At the Africa Investment Forum organized by the African Development Bank and its partners in 2019, investment interest was secured for projects worth $40.1 billion, in less than 72 hours. And investors came from 101 countries in the world, with 61 being outside of Africa.

Second, the UK can support Africa in the financial services sector.

Third, the composition of trade between the UK and Africa should change. The UK should support Africa to integrate rapidly into the global value chains.

Turning things around must start with a critical look at the current trade regime and design new arrangements for the future.

The Economic Partnership Agreement on trade with Africa, under which the UK was involved, was about a partnership of unequals.

The engagement should be about a partnership of equals. And you can understand why.

Just think of this for a moment:

Africa, with its Continental Free Trade Area, a huge market size of $3.3 trillion, is now the largest free trade area in the world since the creation of the World Trade Organization. With harmonized tariffs, rules, and standards, that is a market no one can ignore in the world.

The times have changed. The engagement must change.

This is a new Africa.

The UK and Africa must now engage differently, boldly and strategically for mutual benefits. It will be partnerships of equals.

The UK will not need to negotiate with each of the 54 African countries individually but can negotiate with Africa as a bloc.

The terms of engagement must also change. It’s time to put new wine in new wine bottles. The negotiations with Africa as a bloc must learn from the challenges and pitfalls of the EPAs signed by the EU with African regional economic communities.

These arrangements essentially disadvantage African countries, as they differentiate access across countries, based on classification of whether they are developing or underdeveloped.

It was about “divide and trade”.

Such differentiation discourages regional integration. It’s clear that African countries will not be interested in rolling over these EPAs during the post-Brexit transition period. `

What Africa needs is “unite and trade”

What Africa needs is “unite and trade”.

With Brexit, Africa should renegotiate quota-free, duty-free access to the UK market while liberalizing its own markets for UK goods. The new re-engagement should be based on respected mutual trust.

As such, the UK should remove the non-execution clause that currently exists under EPA with the EU, which gives power to suspend trade commitments due to political issues.

Trade should be purely around economic and trade concerns.

To improve trade relations, there’s a need to make sure that the favorable treatment clause is more favorable in new trade agreements with Africa.

As the UK engages with trade arrangements with other parties, African goods and services should be treated more favorably.

Africa doesn’t just want to trade. Africa wants to also industrialize. Africa no longer wants to export raw materials but value-added products.

The new UK trade engagement with Africa should avoid rules of origin that perpetuate the exports of primary products from Africa.

Flexibility to rules of origin should allow components to be sourced regionally in Africa but production done domestically. This will allow for the emergence and development of regional value chains, expand value-added products from Africa and increase the value of products to the UK market from Africa.

The food and agriculture space offers huge opportunities for African countries to export to the UK market. While the EU Common Agriculture Policy (CAP), which also included the UK, has been harmful to agriculture in Africa – due to massive subsidies – it’s time now for the UK to turn the page and engage differently on agriculture.

A new policy framework that replaces the CAP with more market-friendly policies that create incentives for the export of value-added food and agriculture products from Africa to the UK market would be essential to boost value-added trade.

Of course, there will be a need to reduce or remove the non-tariff barriers to value-added products from Africa.

The UK should not look at Brexit from the angle of “damage control” but from the perspective of “opportunity”.

As the UK looks out of Europe, the UK should look towards Africa. That’s the market of the future.

As the UK and Africa recalibrate and engage in mutually beneficial trade and investment, the challenges of today will become the vast opportunities of tomorrow.

With every change come fears, anxieties and trepidation.

A child in the womb that has been cozy there for 9 months suddenly has to get out of the womb. It’s a Womb-Exit!

All you hear are cries as the new baby enters a new world. But as soon as they’re over that and get used to their new environment of the world, they never want to leave anymore.

Like the case of Hem and Haw in the best-selling book by Spencer Johnson, Who Moved My Cheese?, Haw sought opportunities to find new cheese. Hem never moved on, troubled that their cheese had gone. It is time to do a writing of Haw on the wall: “The quicker you let go of the old cheese, the sooner you can find the new cheese.”

The UK should look for new cheese.

And for that it should look towards Africa!

*The President of the African Bank delivered this speech on January 21 in the British Parliament on the sidelines of the UK-Africa Summit