African Start-Ups : an ecosystem in full evolution despite a decline in investments

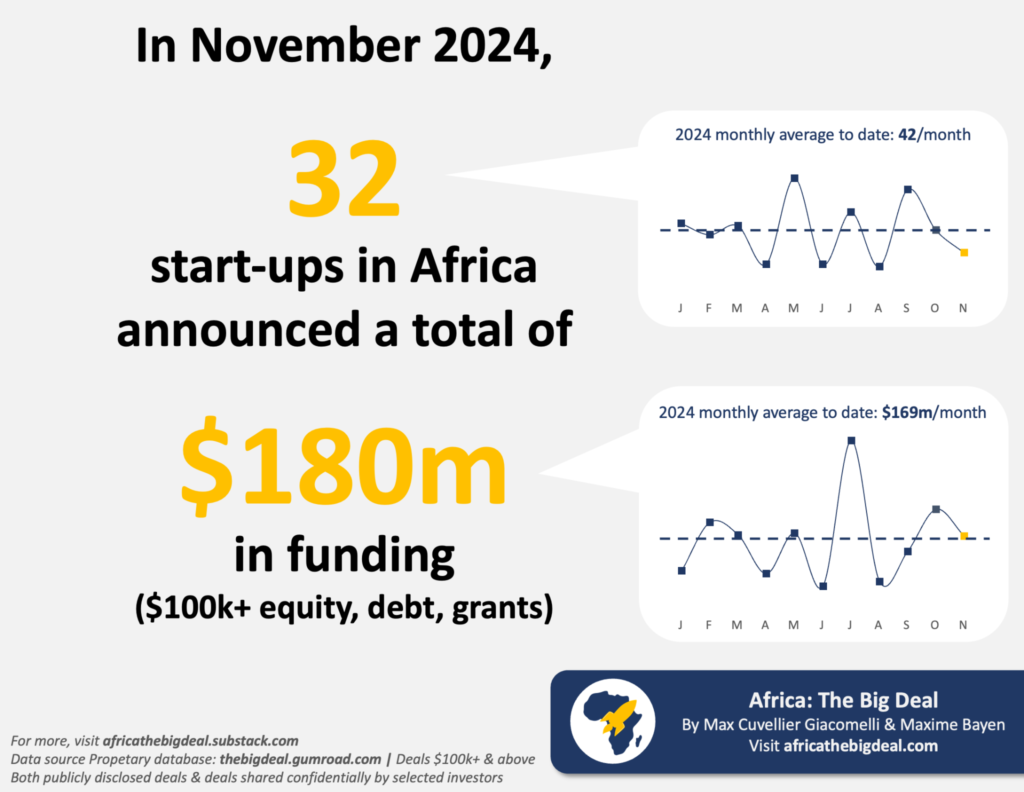

$180 million. This is the latest figure for funds raised by African start-ups, according to the report from the platform Africa: The Big Deal. Although the total amount of investments has declined compared to the previous year, the African tech ecosystem continues to demonstrate its attractiveness, particularly in the fields of energy and digital innovation.

According to data published by Africa: The Big Deal, African start-ups raised a total of $180 million in November 2024, a significant figure that reflects the global context of slowing investment. Of this amount, $122 million (68%) came from debt financing, $55.5 million (31%) from equity investments, and $2.5 million (1%) from grants.

Since the beginning of the year, African start-ups have raised a total of $1.86 billion, including $1.2 billion (64%) in equity investments, $635 million (34%) in debt, and $33 million (2%) in grants. In comparison, these figures represent a 34% decline from the $2.8 billion raised in 2023.

« Nigeria and Kenya continue to lead »

Among the most attractive countries, Nigeria and Kenya remain dominant, accounting together for 76% of the funds raised since January 2024. This distribution confirms these two nations’ position as technological hubs in Africa, thanks to their dynamic ecosystems and ability to attract investors.

In November, the flagship transaction was carried out by Sun King, a Nigerian company specializing in off-grid solar energy solutions. The company secured an $80 million loan from the International Finance Corporation (IFC), representing 44% of the total funds raised during the month. This interest in sustainable energy solutions highlights the importance of investments in strategic sectors addressing local needs.

Resilience and attractiveness

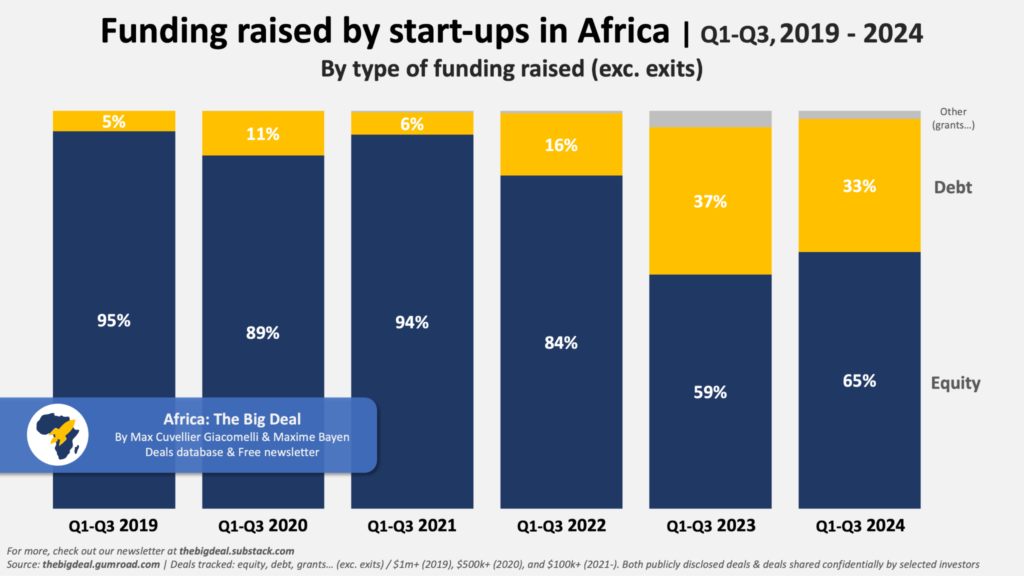

Despite the decrease in investment volumes, several trends underline the resilience and attractiveness of the African technological ecosystem. The diversification of funding sources, with a growing share of debt in fundraisings, reflects the evolution of start-ups’ strategies in response to the scarcity of venture capital.

Investors continue to target priority sectors such as energy, fintech, and agritech, which directly address local needs while offering significant growth potential. Furthermore, the emergence of incubators, accelerators, and local funds in countries such as Egypt or South Africa is further structuring the ecosystem, offering a broader diversity of opportunities.

Outlook for 2025 : A moderate recovery

As 2024 comes to an end, sector players anticipate a moderate recovery in 2025, supported by government initiatives and digitalization projects. The improvement of digital infrastructures and expanded access to funding for emerging start-ups will play a key role in this process.

However, global economic instability and challenges related to inflation will continue to weigh on investors. To remain competitive, African start-ups will need to rely on innovative, sustainable business models adapted to local needs.