African Banks : Heading to Dubai and Riyadh to Capture the Africa–Gulf Financial Corridor

As several major African banks are now talking about opening offices in Dubai or Riyadh, this is no longer just a geographic choice. It represents a strategic shift that sheds light on the restructuring of financial flows between Africa and the Middle East.

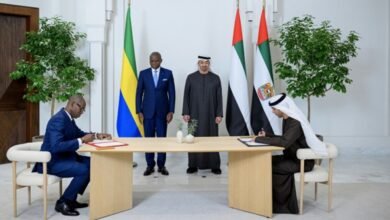

Recently, several major African banks have confirmed plans to establish a presence in Gulf financial centers, marking a strategic turning point for the continental banking sector. Among them, Absa Group, based in South Africa, announced its decision to open a representative office in Dubai in the first quarter of 2026, pending regulatory approval. As Yasmin Masithela, CEO of Absa’s Corporate & Investment Banking unit, explained: “We are setting up a Dubai office in the first quarter of 2026… We are just waiting for regulatory approval.”

The office in the United Arab Emirates is a strategic bridge connecting Africa’s entrepreneurial energy to global capital

At the same time, Equity Group Holdings, the largest Kenyan banking group, received shareholder approval to open a representative office in the United Arab Emirates, a decision announced at the annual general meeting on June 25, 2025. CEO Dr. James Mwangi emphasized that “the office in the United Arab Emirates is a strategic bridge connecting Africa’s entrepreneurial energy to global capital.”

Meanwhile, United Bank for Africa (UBA), a pan-African bank, is already present in Dubai through a subsidiary at the Dubai International Financial Centre (DIFC). The group highlights on its website that “UBA Group is the first pan-African bank to establish a branch at the DIFC directly from Nigeria.”

African banks are no longer content to serve their traditional markets; they are seeking to capture Gulf capital flows and support investments back to the continent

These moves reflect a clear strategic repositioning. African banks are no longer focused solely on serving their traditional markets; they are aiming to capture Gulf capital flows and facilitate investments into the continent. This approach aligns with a broader trend of Gulf countries intensifying their investments in Africa. According to the World Economic Forum, Gulf countries have invested over USD 100 billion in Africa since 2014, and trade between the United Arab Emirates and Sub-Saharan Africa has increased by more than 30% over the same period. Trade between Saudi Arabia and the region has, in turn, multiplied twelvefold.

This dynamic also reflects the need for African banks to diversify their international footholds. Absa emphasizes that having a presence in Dubai allows the bank to be “closest to clients driving business aligned with their strategy.” Similarly, Equity Group explains that its office in the UAE will facilitate trade and investment between East and Central Africa and the broader Middle East, India, and Asia.

Accessing New Capital

For Africa, this repositioning carries concrete potential. It provides an opportunity to access new capital, better serve the African diaspora residing in the Gulf, and facilitate trade. In UBA’s case, the Dubai branch specifically targets large corporations and financial institutions, reinforcing its role as a bridge between Africa and the Middle East.

However, this repositioning also raises crucial questions. How will these offices translate into tangible financing for Africa’s real economy? Is opening branches sufficient to create meaningful projects, or is it merely symbolic? Furthermore, what impact will this strategy have on banking services for individuals and the African diaspora in the Gulf? Currently, some branches, such as UBA at DIFC, operate exclusively for large corporations and institutions, which limits direct effects on retail customers.

Finally, this strategy raises the question of dependency versus diversification. By concentrating their financial hubs in the Gulf, are African banks at risk of becoming overly reliant on external capital, or is this the start of effective diversification, ensuring more resilient and evenly distributed financial flows? The ability of African banks to structure local projects, embed their services in African realities, and maintain transparency will be decisive for the success of this initiative.

A Sign of Redefining Africa–Middle East Economic Relations

Ultimately, the strategic choice of African banks to establish themselves in hubs like Dubai or Riyadh illustrates a redefinition of Africa–Middle East economic relations. Africa is no longer only looking west; it is now choosing the southeast to capture capital, better serve its diaspora, and support infrastructure and service projects.

For this ambition to materialize, the major challenge for Africa is to transform these hubs into true value bridges: tangible financing, structured African projects, real inclusion of the diaspora, and solid regional anchoring. This represents a new step in the continent’s financial development while remaining faithful to its needs and economic sovereignty.