AAM2025 : Afreximbank at a Crossroads

From June 25 to 27, 2025, Abuja will host the 32nd Annual General Meeting (AGM) of the African Export-Import Bank (Afreximbank). The event, themed "Building the Future on Decades of Resilience," crystallizes the major economic challenges of the moment: strengthening regional integration, structuring Africa-Caribbean relations, and mobilizing massive financing amid global uncertainty. As Professor Benedict Oramah prepares to hand over leadership, the bank is entering a new era.

In Abuja, Nigeria’s capital, Afreximbank is organizing its 32nd Annual General Meeting (AGM2025) from June 25 to 27. This marks a symbolic return to Africa after the 2024 edition held in the Bahamas, against a backdrop of rising geopolitical and economic uncertainty worldwide.

AAM2025 comes at a pivotal moment for Africa: it is now about catalyzing concrete action, building stronger institutions, and unlocking the full potential of African innovation

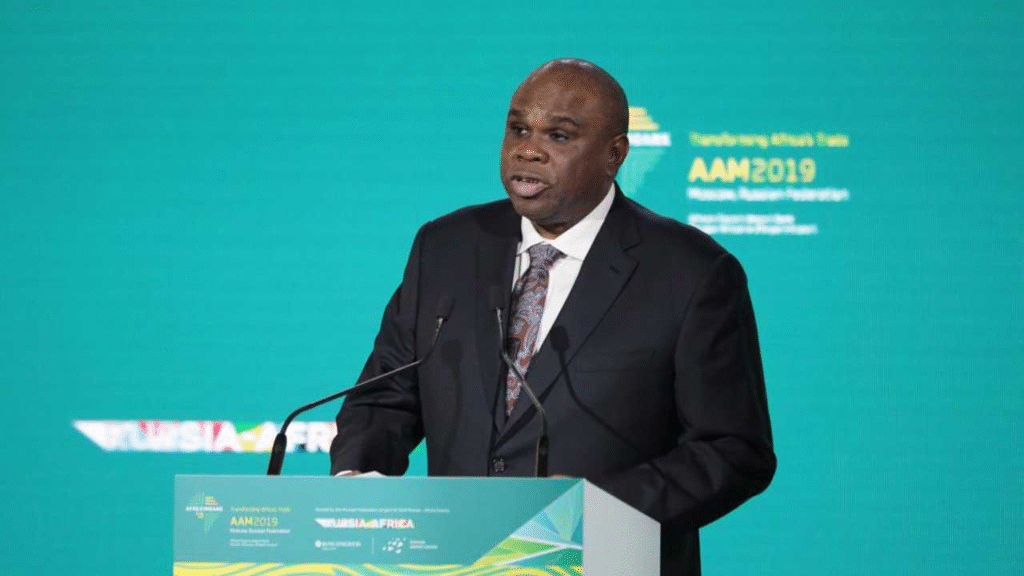

For Professor Benedict Oramah, President and Chairman of Afreximbank’s Board, these assemblies occur at a decisive time: “AAM2025 comes at a pivotal moment for Africa. While the continent faces global uncertainties, it does so with renewed determination. It is now about catalyzing concrete action, building stronger institutions, and unlocking the full potential of African innovation.”

This Abuja edition aims to address three structural priorities.

First, to concretize the implementation of the AfCFTA (African Continental Free Trade Area) with support from a $10 billion Adjustment Fund deployed by Afreximbank, designed to assist member states during the initial phases of application.

Second, to accelerate Africa-Caribbean trade, notably through the upcoming AfriCaribbean Forum (ACTIF2025) scheduled in Grenada from July 28 to 29, under the theme “Resilience and Transformation.” Trade between the two regions could reach $1.8 billion by 2028, according to the International Trade Centre (ITC).

Finally, to mobilize massive financing for key sectors through new Memorandums of Understanding (MoUs) and public-private partnerships, representing billions of dollars over the next 5 to 10 years.

According to Vincent Musumba, Head of Communications and Events at Afreximbank: “AAM2025 is expected to facilitate significant financing deals for strategic sectors such as energy, health, infrastructure, and industrialization.”

Afreximbank: A continental economic lever

Today, Afreximbank stands as a pillar of Africa’s economic transformation. By the end of December 2024, the bank reported total assets and commitments exceeding $40.1 billion, with equity reaching $7.2 billion. Rated “investment grade” by multiple international agencies (Moody’s: Baa1; Fitch: BBB; GCR: A), it now operates as an integrated group (bank, investment fund FEDA, insurance AfrexInsure).

Afreximbank plays a central role in realizing the AfCFTA by actively supporting its implementation with innovative financial and technical instruments. Alongside the African Union and the AfCFTA Secretariat, the bank established a $10 billion Adjustment Fund to help member states transition towards a single market, notably compensating for customs revenue losses and financing structural reforms. It also pioneered the Pan-African Payment and Settlement System (PAPSS), adopted by the African Union as the official platform for cross-border payments in local currencies. This system revolutionizes intra-African trade by reducing reliance on the dollar, conversion costs, and transaction times.

In parallel, Afreximbank has positioned itself as a pioneer in developing the cultural and creative industries (CCI) through its CANEX program. In 2020, it launched a dedicated $500 million fund to support this strategic sector, financing audiovisual production, music, publishing, and African digital platforms. The fund aims to boost the export of African content and position culture as a lever for economic development and global influence.

Finally, the bank initiated a structured opening toward the Caribbean region, with the creation of the AfriCaribbean Forum (ACTIF) and the groundbreaking in March 2025 of the African Trade Centre in Bridgetown (Barbados). This economic and cultural hub embodies the desire to institutionalize Africa-CARICOM relations and build a South-South corridor for trade, investment, and cultural exchange. The launch of the African Trade Centre in Bridgetown in March 2025 marks the first physical hub for Africa-Caribbean trade, materializing the bank’s transatlantic ambitions.

Actions to credit to Dr. Benedict Oramah. Appointed head of the institution in 2015, Dr. Oramah leaves behind a profoundly transformed Afreximbank, having redefined its role and influence on the African and international stage as he prepares to hand over the reins.

Final term for Professor Oramah: A legacy to sustain

Under Dr. Benedict Oramah’s leadership, Afreximbank has solidified its position as a key player in financing intra-African trade. In 2024, the bank reported a net income of $973.5 million, a 29% increase from the previous year, with total assets reaching $40.1 billion, up 7.55%. This performance aligns with the implementation of the Sixth Strategic Plan, aimed at strengthening operational efficiency and diversifying revenue streams. The cost-to-income ratio decreased to 18%, down from 19% in 2023, despite higher operating expenses due to inflation and business expansion.

One of Oramah’s flagship projects is the Pan-African Payment and Settlement System (PAPSS), launched in 2022. This system enables instant cross-border payments in local currencies, reducing transaction costs and settlement times. According to Reuters: “PAPSS has the potential to generate annual savings of $5 billion in intra-African transfer fees.”

Furthermore, Afreximbank has supported major infrastructure projects such as the construction of the Dangote Refinery in Nigeria, contributing to the continent’s industrialization. Dr. Oramah emphasized the importance of such initiatives: “We are committed to creating an environment where African trade thrives, supported by innovative solutions and strengthened cooperation.”

Finally, the bank has strengthened ties with the African diaspora by launching the AfriCaribbean Forum (ACTIF) and establishing the African Trade Centre in Bridgetown, thereby facilitating economic and cultural exchanges between Africa and the Caribbean.

Challenges ahead: Financial integration and global volatility

While leaving a solid and credible institution mobilized on multiple strategic fronts to his successor, Afreximbank faces several major challenges. Firstly, global macroeconomic volatility — inflation, monetary tightening, supply chain fragmentation — complicates the mobilization of long-term capital for high-impact projects. Secondly, weak financial integration among African countries hampers full utilization of PAPSS and limits leverage effects of intra-African trade. Additionally, rising sovereign risks and institutional fragilities in some regions increase pressure on risk management. Finally, achieving sustainable economic cooperation with the Caribbean will require sustained commitment to bridge regulatory, logistical, and linguistic gaps.

Heading to Abuja: A pivotal edition for Afreximbank

AAM2025 takes place at the intersection of continental ambition, global alliances, and the necessity to adapt to global instability. The challenge for Afreximbank is to stay the course in a shifting world while ensuring the transition of leadership to a new governance. Abuja promises to be a key moment in this transition.