African Economic Outlook 2025 : turning resources into growth

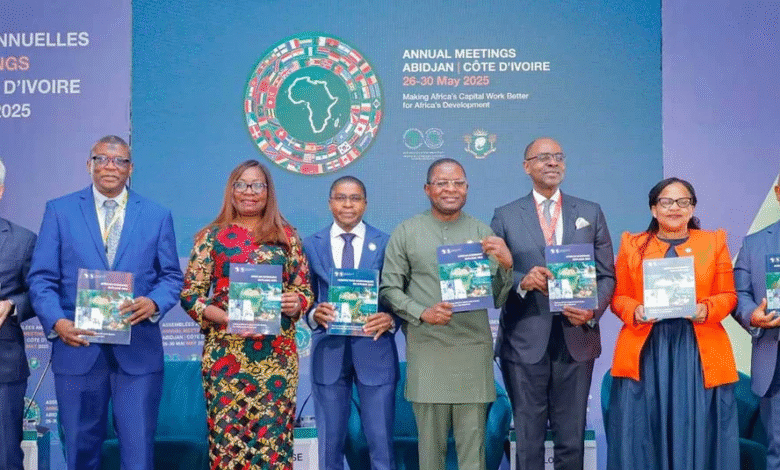

Despite global uncertainties and persistent economic challenges, Africa is poised for stronger growth in 2025 and beyond. The African Economic Outlook 2025, launched during the African Development Bank’s Annual Meetings in Abidjan, outlines a clear path: by mobilizing its untapped domestic resources—natural, financial, human, and business capital—the continent can accelerate its development and reduce dependence on external aid.

Africa’s economy is proving its resilience. According to the African Economic Outlook 2025, the continent is expected to grow from 3.3% in 2024 to 3.9% in 2025, and to 4% by 2026—outpacing global averages despite geopolitical turbulence and tightening global financial conditions.

Presented at the African Development Bank’s Annual Meetings in Abidjan, Côte d’Ivoire, the report titled “Making Africa’s Capital Work Better for Africa’s Development” highlights the continent’s enduring potential. It calls for strategic reforms to harness Africa’s vast internal resources.

Africa must now face the challenge and look inwards to mobilizing the resources needed to finance its own development in the years ahead

“Africa must now face the challenge and look inwards to mobilizing the resources needed to finance its own development in the years ahead,” said Prof. Kevin Chika Urama, Chief Economist and Vice President of the African Development Bank Group.

East Africa leads the continental outlook with a projected growth rate of 5.9% in 2025-2026, supported by robust performances in Ethiopia, Rwanda, and Tanzania. West Africa is expected to post 4.3% growth, largely fueled by new oil and gas developments in Senegal and Niger. North Africa should see 3.6% growth, while Central Africa’s pace slows to 3.2%. Southern Africa, weighed down by South Africa’s sluggish 0.8% expansion, is forecast to grow by only 2.2%.

Despite these gains, challenges remain significant. Fifteen African countries are currently facing double-digit inflation. Moreover, interest payments have surged to 27.5% of total government revenues—up from 19% in 2019—placing added strain on public finances.

The report highlights Africa’s tremendous potential to mobilize domestic resources. With targeted reforms, the continent could generate up to $1.43 trillion in additional revenue from both tax and non-tax sources.

Among the key levers identified, natural capital stands out prominently: Africa holds around 30% of the world’s mineral reserves and could, by 2030, capture over 10% of the estimated $16 trillion in global revenues from strategic « green » minerals. Human capital is another major asset, with a median population age of just 19; better inclusion of young people in the economy could add $47 billion to Africa’s GDP.

Financial capital also offers strong potential. African pension funds now hold more than $1.1 trillion in assets, while formal remittances could reach $500 billion by 2035—if transfer costs are reduced. Lastly, entrepreneurial capital, driven by the implementation of the African Continental Free Trade Area (AfCFTA), could generate up to $560 billion in additional exports and increase African income by $450 billion over the same period.

These assets can help the continent develop along more autonomous, inclusive, and sustainable lines.

Plugging the leaks

While Africa received $190.7 billion in financial inflows in 2022, it lost an estimated $587 billion to various leakages. These include $90 billion in illicit financial flows, $275 billion through profit shifting by multinationals, and $148 billion lost to corruption.

When Africa allocates its own capital—human, natural, fiscal, business, and financial—effectively, global capital will follow Africa’s capital to accelerate investments

Vice President Urama emphasized

The report advocates for bold reforms to transform the way Africa mobilizes its domestic resources. It calls for improving tax efficiency through digital modernization of tax administrations, broadening the tax base, and building citizen trust to encourage voluntary compliance.

Maximizing natural capital, meanwhile, requires making environmental accounting standard practice and adopting policies that promote local value addition to extracted resources.

There can be no substitute for sound macroeconomic policy management, quality institutions, good governance, and the rule of law

In terms of financial development, the report emphasizes the need to deepen capital markets—especially local currency bond markets—mobilize institutional savings, and harmonize regulatory frameworks to enable cross-border investments.

Finally, governance remains a cornerstone: the report stresses the importance of strengthening institutions, upholding the rule of law, and promoting budget transparency, all seen as critical pillars for achieving sustainable and inclusive growth.

“There can be no substitute for sound macroeconomic policy management, quality institutions, good governance, and the rule of law,” said Urama.

The African Economic Outlook 2025 sends a clear message: Africa holds the keys to its own transformation. By optimizing its abundant internal resources and minimizing capital leakages, the continent can secure sustainable and inclusive growth. The challenge now is to turn vision into action.