Report: A leap forward for Fintech in Africa stalled by high financing costs

The European Investment Bank’s (EIB) annual "Finance in Africa" report reveals significant progress in the African Fintech sector, with the number of companies tripling since 2020. However, high financing costs continue to be a major barrier to the continent's digital and climate transitions.

The European Investment Bank (EIB) has released its annual « Finance in Africa » report, an in-depth analysis of the evolution of Africa’s financial sector. Based on the « Banking in Africa Survey 2024, » conducted between February and March 2024 with 51 banks across Sub-Saharan Africa, the report highlights positive developments in financial sectors but also points to persistent challenges, particularly high financing costs.

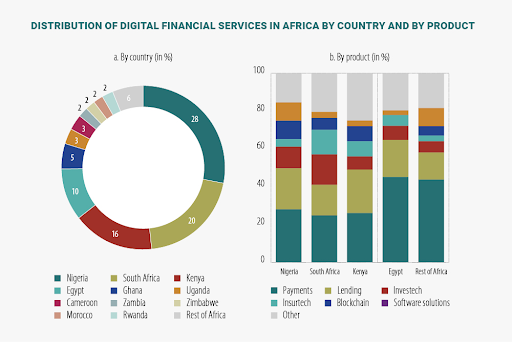

A spectacular growth for Fintech

One of the key takeaways from the report is the remarkable growth of the Fintech sector in Africa. The number of companies offering innovative financial products and services has nearly tripled, rising from 450 in 2020 to over 1,250 in 2024. This evolution demonstrates the rising power of Fintech, which is improving access to finance for individuals and businesses across the continent, especially in areas where traditional banking services are limited.

Indeed, these companies are playing a crucial role in financial inclusion in Africa, where many individuals and businesses do not have access to traditional banking services. Fintech solutions help overcome infrastructure challenges and offer financial services that are tailored to local realities.

Persistent challenges: Financing costs and transition

Despite these advances, the EIB report highlights a major challenge: high financing costs. These continue to hinder the investments needed to support Africa’s digital and climate transitions. Companies, especially in the technology and clean energy sectors, are struggling to access affordable financing to support their projects. This is particularly concerning for businesses looking to transition to sustainable and digital models but facing prohibitive interest rates.

Sustainability at the core of banks’ concerns

The report highlights that 70% of banks in Africa have implemented a climate change strategy. This is a strong indication that financial institutions on the continent are beginning to take sustainability seriously. However, the implementation of these strategies is often complex due to financing costs and the lack of institutional support.

Furthermore, the EIB reveals that 72% of banks have a gender strategy in place, with 17% planning to implement one soon. This figure shows a growing awareness of the need to include women in economic processes, a trend that is part of a broader effort to strengthen inclusion and diversification in financial sectors and beyond.

Financial inclusion: visible progress for women-led businesses

The report also highlights a positive trend regarding women-led businesses. Nearly 70% of banks report lower non-performing loan rates for women-led businesses, suggesting that women often manage their companies more prudently. This observation is a step forward for gender equality in business, and also for the economy in general, as it shows that women are becoming increasingly integrated into the economic fabric of the continent.

Africa faces a financing challenge

In conclusion, while Africa has made significant strides in financial inclusion, particularly through the rise of Fintech, high financing costs remain a major obstacle to the digital and climate transitions. It is crucial that African governments, international financial institutions, and private sector actors collaborate to reduce these costs and facilitate access to financing, especially for sustainable and digital projects. Concerted action in this area is essential for enabling Africa to unlock its economic potential while contributing to global climate efforts.

For the full report: Finance in Africa