Saudi Arabia : a new african gold market to challenge Dubai

Saudi Arabia is entering the African gold trade by forging a strategic partnership with Sudan. This initiative could disrupt Dubai’s long-standing dominance and offer Khartoum a more transparent and profitable channel for its mineral wealth.

Saudi Arabia announced that it is ready to begin purchasing Sudanese gold immediately, positioning itself as a major player in Africa’s gold trade. This move aims to provide Sudan with a safer and more profitable market while breaking its historical dependence on Dubai.

The announcement followed high-level discussions in Riyadh between Bandar bin Ibrahim Al‑Khorayef, Minister of Industry and Mineral Resources of Saudi Arabia, and Nour al‑Dayem Taha, Sudanese Minister of Mines, during the 5th Future Minerals Forum, held in Riyadh, Saudi Arabia, from January 13 to 15, 2026, which gathered representatives from over 100 countries.

This cooperation aims to ensure a safer and more profitable pathway for Sudan’s mineral wealth

An operational agreement was subsequently confirmed between a Sudanese delegation, led by Mohammed Taher Omar, Director General of the Sudanese Mineral Resources Company (SMRC), and Suleiman bin Saleh al‑Othaim, Chairman of the Saudi Gold Refinery Company—an integrated refinery ready to process Sudanese gold. Minister Taha reiterated, “This cooperation aims to ensure a safer and more profitable pathway for Sudan’s mineral wealth.”

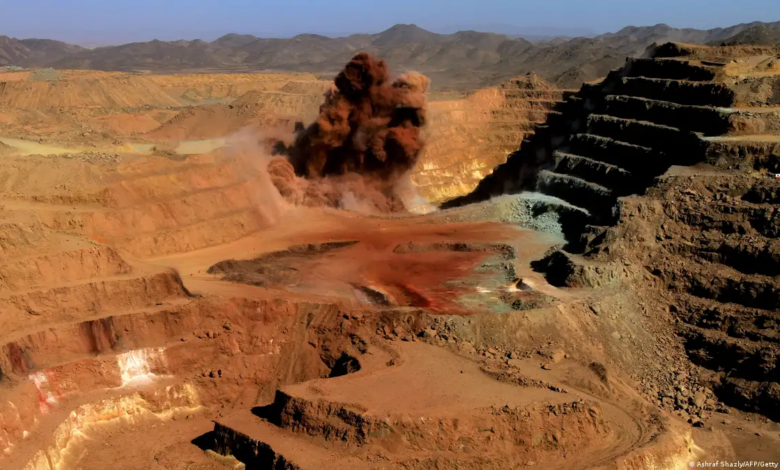

Sudan’s gold production reaches around 70 tonnes, a record level despite internal conflict

In 2025, according to data published by the Sudanese Ministry of Mines via SMRC, Sudan’s gold production reached approximately 70 tonnes, a record level despite the ongoing internal conflict, generating estimated revenues of around USD 1.8 billion in the mining sector. Meanwhile, the United Arab Emirates imported 748 tonnes of gold from Africa in 2024, representing an 18 % increase from the previous year, according to UN Comtrade export statistics. Of these volumes, 29 tonnes came directly from Sudan in 2024, up from 17 tonnes in 2023, according to the same source. These figures highlight the scale of gold flows between Africa and Gulf hubs, although a significant portion may still transit via unofficial channels before being recorded.

According to an independent study published by SWISSAID in 2024, between 321 and 474 tonnes of African gold are smuggled annually, representing USD 24–35 billion, often via Gulf markets before being re-exported.

A Sudanese strategic shift

For Sudan, this new partnership provides a more transparent and secure alternative, likely to reduce parallel market activity and increase official gold revenues. The country seeks to further formalize exports and revive exploration and production projects awaiting technical and financial support.

Ahmed Haroun al‑Tom, Director General of the Sudanese Geological Research Authority, noted that discussions also covered granting Saudi companies exploration rights for other industrial minerals such as talc, mica, chrome, and manganese.

A direct challenge to Dubai

Historically, Dubai has maintained a dominant position as a global gold trading platform and de facto central hub for African gold, including undeclared flows. Analysts believe that this shift toward Riyadh not only secures a more profitable market for Sudan but also constitutes a strategic challenge to Dubai’s dominance in East and Central African gold trade.

“FMF is a cause driven from Saudi Arabia, one that brings the world together to deliver the minerals for creating a new era of global development, prosperity, and stability for supplier nations”, said Bandar bin Ibrahim Al‑Khorayef, Minister of Industry and Mineral Resources of Saudi Arabia, at Future Minerals Forum 2026.

This realignment occurs in a complex geopolitical context, including tensions between Khartoum and the UAE over the role of gold trade in fueling Sudan’s internal conflict. For Riyadh, the operation forms part of a broader strategy of economic expansion beyond hydrocarbons, diversification of trade routes, and strengthening influence in Africa.

The urgency of adopting transparent and efficient regional financial instruments

For Africa, this development illustrates the growing international interest in the continent’s mining sector, encouraging producing countries to diversify trade partners. It also underscores the need for transparent and effective regional financial instruments, such as regional mining bonds or frameworks inspired by Saudi and Western models, to attract capital and reduce dependence on external intermediaries. The Sudanese example demonstrates that a strategic state-level partnership, supported by robust industrial and logistical capacities, can both secure mining revenues and attract investment for sustainable sector development.