By Apanisile Temitope Samuel, PhD

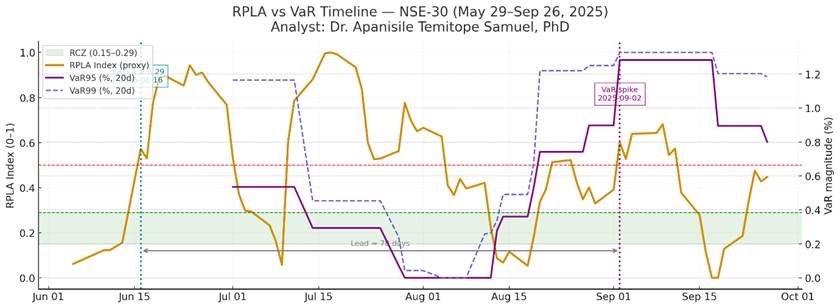

While Nigeria’s blue-chip NSE-30 index surged about 25% from 29th May 2025 to 26th September 2025—climbing from around 4,120 to 5,180 points—a closer look reveals silent fragility building beneath the surface. Driven by banking heavyweights and foreign inflows, this rally masked systemic vulnerabilities that could spill over into broader African markets. Using a novel early-warning tool called the Risk Pressure Level Assessment (RPLA), my analysis uncovers these hidden risks two months before traditional metrics like Value-at-Risk (VaR) flagged them, offering investors a proactive edge in turbulent times.

The NSE-30, tracking Nigeria’s 30 largest and most liquid stocks, is a bellwether for Africa’s second-largest economy. Weighted heavily toward banking, consumer goods, oil & gas, and telecoms, it includes giants like MTN Nigeria, GTCO, Zenith Bank, and Dangote Cement. The period saw semi-annual rebalancing in July, with Aradel Holdings and Wema Bank replacing Conoil and Julius Berger, signalling shifts in energy and fintech. Yet, amid naira stabilization and inflation peaking at 34%, the index’s gains hid interdependencies that RPLA exposed early.

While Nigeria’s market rallies, systemic fragility hides in plain sight

RPLA, a nonlinear framework I developed, shifts risk analysis « upstream of probability. » It measures three capacities—anticipating shifts, quantifying changes, and uncovering patterns—combined into an index from 0 to 1. Scores below 0.15 indicate rigidity; 0.15–0.29 is the « Requisite Complexity Zone » for resilience; above 0.30 signals chaos or collapse. For the NSE-30, RPLA crossed fragility thresholds in June, well before VaR spikes in August, giving a critical lead time.

Key findings paint a picture of concentrated fragility. Banking dominated systemic pressure, with UBA (0.083 share), ZENITH (0.076), and WAPCO (0.071, an industrial cement player) topping the rankings. These reflect liquidity tightness, non-performing loans (NPLs), and FX exposures amplifying shocks across the index. Consumer firms like DANSUGAR (0.071) and GUINNESS (0.043) added layers of demand volatility and inflationary stress, while mid-tier banks like STERLING (0.068) and ACCESSCORP (0.067) acted as transmission nodes.

RPLA isn’t just about spotting losses—it helps understand why fragility builds, empowering proactive resilience

As one analyst from Coronation Securities noted in July 2025, « Liquidity tightness and NPL risks are weighing on banks, potentially curbing credit growth. » This echoes RPLA’s detection of banking as the fragility epicenter, where interbank exposures could cascade into wider economic drags.

On the flip side, pockets of resilience emerged. Stocks like BUAFOODS (-0.006 pressure), TOTAL (-0.002), and AIRTELAFRI (-0.002) played stabilizing roles, absorbing shocks rather than amplifying them. These fall into RPLA’s Requisite Complexity Zone, showcasing strong fundamentals: balanced adaptability to FX swings, inflation, and global oil prices. BUA Foods, for instance, dampened consumer sector volatility through its counter-cyclical positioning.

Visual timelines from the analysis highlight RPLA’s advantage: While the index’s daily returns showed fat tails—deviating from normal distributions in P-P plots—RPLA signaled structural instability in June, before August’s volatility dips. Traditional VaR95 (-0.78%) and VaR99 (-1.33%) underestimated these tails, reacting only after the fact.

This aligns with market commentary. Cordros Capital’s August outlook warned of narrowing breadth, with banks dominating moves, while BusinessDay Nigeria in September flagged FX volatility hitting industrials like WAPCO. Follow-the-Money’s August report on « hidden systemic risks in leverage » mirrors RPLA’s uncovering of interdependencies absent in standard models.

A crisis in Nigeria’s banking sector could trigger ripple effects across West African markets, given regional interconnections

For investors, the implications are clear. Nigeria’s market, resilient on the surface, risks over-reliance on fragile sectors like banking. Pan-African portfolios should prioritize Requisite Complexity Zone (RCZ) stocks like BUAFOODS for ballast against potential banking spills. As Dr. Apanisile Temitope Samuel explains, « RPLA isn’t just about spotting losses—it’s about understanding why fragility builds, empowering proactive resilience. » Nigeria, contributing approximately 17% to sub-Saharan Africa’s GDP, drives regional trade and investment. Moreover, its banking sector’s estimated $50 billion in cross-border assets (industry estimate, 2025) amplifies regional risk, where a crisis could disrupt West African markets, given NSE-30 stocks like MTN and Dangote Cement hold significant cross-border stakes.

African economies, interconnected through trade and finance, stand to benefit from such tools. With Nigeria’s index setting the tone, early signals could prevent contagion. Investors: Diversify into stabilizers, monitor banking pressures, and integrate pre-probabilistic analytics for sustainable growth.

The lesson is clear: while Nigeria’s market rallies, systemic fragility hides in plain sight. By integrating pre-probabilistic analytics like RPLA, investors and policymakers alike can gain critical lead time, ensuring Africa’s growth story is built on resilience, not fragility.

Table 1: Stock-Level Pressure Ranking (May–Sep 2025)

| Rank | Stock | Pressure Share | Interpretation |

| 1 | UBA | 0.083 | Highest systemic driver; fragility concentrated in Tier-1 banking. |

| 2 | ZENITH | 0.076 | Reinforces systemic pressure from large-cap banks; liquidity stress. |

| 3 | WAPCO | 0.071 | Industrial risk tied to input cost & FX exposures in cement sector. |

| 4 | DANSUGAR | 0.071 | Consumer fragility driver (import dependency & demand volatility). |

| 5 | STERLINGNG | 0.068 | Mid-tier bank amplifying systemic coupling; credit channel stress. |

| 6 | ACCESSCORP | 0.067 | Large financial cluster driver; transmission of systemic banking shocks. |

| 7 | FCMB | 0.053 | Smaller but relevant banking fragility node. |

| 8 | FIRSTHOLD | 0.050 | Financial services instability node; moderate pressure. |

| 9 | GTCO | 0.048 | Liquidity & credit cycle amplifier within the banking cluster. |

| 10 | GUINNESS | 0.043 | Consumer staples risk under FX and inflationary pressures. |

| 11 | OKOMU | 0.042 | Agricultural/commodities exposure; FX sensitivity. |

| 12 | BUACEMENT | 0.042 | Industrial fragility from cement sector; similar dynamics as WAPCO. |

| 13 | INTBREW | 0.040 | Consumer demand & FX-driven fragility. |

| 14 | MTNN | 0.040 | Telecom fragility; regulatory and FX risks. |

| 15 | NB | 0.033 | Consumer discretionary stress channel. |

| 16 | TRANSCORP | 0.032 | Energy/hospitality exposure; hybrid systemic linkages. |

| 17 | IBTC | 0.031 | Financial services stability node; smaller systemic share. |

| 18 | FIDELITY | 0.024 | Banking fragility, though less systemic than peers. |

| 19 | PRESCO | 0.022 | Agri-business fragility; commodity-linked volatility. |

| 20 | ETI | 0.019 | Cross-border banking fragility with regional exposures. |

| 21 | DANCEM | 0.019 | Industrial node; lower systemic share compared with WAPCO/BUA. |

| 22 | NESTLE | 0.017 | Not an amplifier like banks or WAPCO, nor a stabilizer like BUA Foods — offers moderate resilience but with cost-driven fragility. |

| 23 | SEPLAT | 0.008 | Oil & gas sector driver; relatively muted systemic transmission this period. |

| 24 | TRANSCOHOT | 0.006 | Hospitality fragility, but minor systemic effect. |

| 25 | UCAP | 0.006 | Asset management exposure; minor contributor. |

| 26 | GEREGU | 0.000 | Neutral systemic role; no net fragility recorded this cycle, Not Active. |

| 27 | AIRTELAFRI | –0.002 | Slight stabilizer; counter-cyclical telecom position. |

| 28 | TOTAL | –0.002 | Oil & gas counter-cyclical stabilizer. |

| 29 | BUAFOODS | –0.006 | Stabilizing role; counter-cyclical effect, dampening systemic fragility. |

Disclosure

The above analysis represents the opinion of the author and is provided for informational and educational purposes only. It does not constitute an investment recommendation, financial advice, or solicitation to buy or sell any security. Investors should carefully consider their individual circumstances and consult with a licensed financial advisor before making investment decisions.

*Apanisile Temitope Samuel, PhD, holds a Doctorate in Business Administration from ESPAM Formation University, Cotonou, and is the founder of Tractacus Global Management Hub, specializing in industry-agnostic nonlinear risk analysis that enables better-informed decision-making.