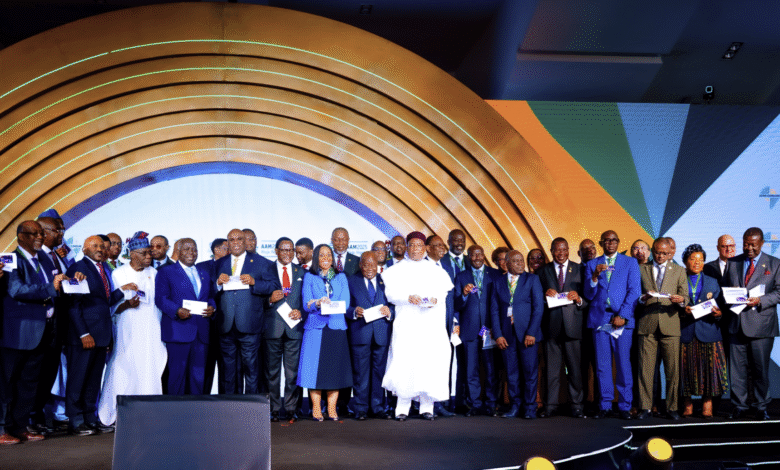

On June 27, 2025, Africa took a major step toward financial independence. In Abuja, Nigeria’s capital, the PAPSSCARD was unveiled during a historic event: Afreximbank’s Annual Meetings. This new payment tool is far more than just a banking service — it represents a structural lever for continental integration, intra-African trade, and economic sovereignty.

A system designed by Africa, for Africa

The result of a collaboration between the African Export-Import Bank (Afreximbank), the Pan-African Payment and Settlement System (PAPSS), and Mercury Payment Services, PAPSSCARD will enable individuals, businesses, banks, and states to carry out secure, fast, and low-cost transactions across African borders — without relying on international networks like Visa or Mastercard.

Until now, most card payments in Africa went through foreign systems, generating high fees and a massive outflow of data. PAPSSCARD aims to change that by processing payments entirely within the continent.

“For too long, our reliance on external systems has hindered trade, increased costs, and weakened our financial sovereignty,” said Benedict Oramah, President of Afreximbank. “PAPSSCARD gives power back to Africa.”

A concrete response to the continent’s needs

More than a technical tool, PAPSSCARD embodies a vision. “It is a symbol of progress and a bold step toward our independence,” emphasized Mike Ogbalu III, CEO of PAPSS.

Muzaffer Khokhar, Executive Chairman of Mercury, added: “We are building a trusted payment brand, shaped by Africa itself.”

The system targets a wide range of stakeholders: governments, central banks, merchants, SMEs, and citizens. It relies on key partnerships with Bank of Kigali, I&M Bank Rwanda, Rswitch, and Unified Payments to ensure smooth rollout across the continent.

A fast-growing market

According to Afreximbank, Africa’s cross-border payments market is estimated at $329 billion in 2025. It could reach $1 trillion by 2035, with an average annual growth rate of 12%. PAPSS, already operational since 2022, is expected to save up to $5 billion per year in transaction fees linked to the use of international payment systems.

These potential savings highlight the importance of a locally designed infrastructure, rooted in African realities and aligned with the goals of the African Continental Free Trade Area (AfCFTA).

A continental integration ambition

PAPSSCARD is part of a broader project: the unification of the continent’s financial systems. By connecting African central banks and regional payment platforms, it helps build an integrated economic space.

John Bosco Sebabi, Acting CEO of PAPSSCARD, believes the system : “will lower costs, spur innovation, and expand access to modern financial services.”

The choice to launch the card in Abuja is no coincidence. As the capital of a dynamic West Africa, the city symbolizes regional momentum toward economic integration. PAPSS was in fact piloted as early as 2021 in the West African Monetary Zone, with promising results.

Challenges to overcome

Despite its ambitions, several challenges remain. Unequal access to digital technologies — especially in rural areas — may slow card adoption. Cybersecurity and regulatory harmonization among AfCFTA member states are also top priorities. Global payment giants such as Visa and Mastercard may also adjust their pricing strategies in response to the rise of a continental competitor.

However, PAPSSCARD has a key advantage: its African legitimacy. “Built by Africa, for Africa,” this card is designed to meet the continent’s economic realities while highlighting local talent and solutions.

Toward an Africa in control of its own finance

PAPSSCARD is more than just a card. It’s a manifesto. It symbolizes an Africa taking control of its destiny, investing in its infrastructure, and strengthening its internal value chains. At a time when global geopolitical tensions are disrupting traditional financial flows, such an initiative marks a turning point.

Financial sovereignty cannot be declared — it must be built. And with PAPSSCARD, Africa has laid a solid first stone.